Investment Solutions:

Discretionary Strategies

Introduction to Discretionary Strategies

Graham allocates capital to experienced portfolio managers with demonstrated success in the markets. The firm allows individual portfolio managers discretion to trade their views within their mandate and the firm’s disciplined risk management infrastructure.

Discretionary Strategies at a glance

Absolute Return

Provides exposure to Graham’s multi-PM macro platform with smaller allocation to quantitative strategies.

Multi-Alpha Opportunity

Provides access to specialist alpha-capturing strategies in addition to core macro component.

Macro UCITS

Provides access to Graham’s multi-PM macro platform within a UCITS compliant structure.

Credit Opportunities

Provides access to a niche long-and-short credit strategy.

Daily Risk Committee Meeting

Absolute Return

Absolute Return is a diversified, multi-manager strategy that allocates to a range of macro-oriented components. Component strategies use a variety of trading methodologies and disciplines that participate primarily in the fixed income, commodity, currency, and equity markets.

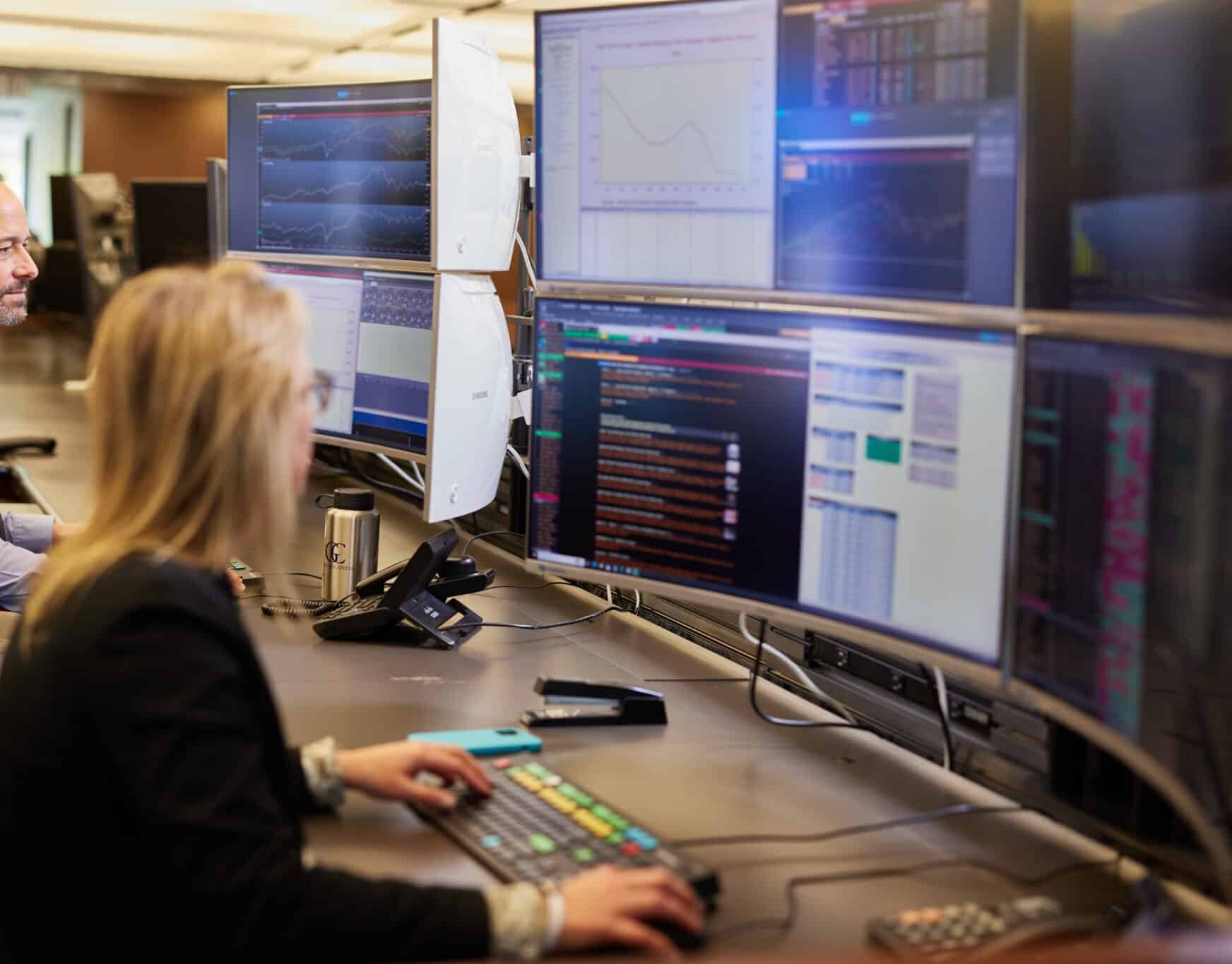

Graham Discretionary Trading Floor

Multi-Alpha Opportunity

Graham’s Multi-Alpha Opportunity provides access to specialist alpha-capturing strategies in addition to a core macro component.

Graham London Office

Macro UCITS

Graham Macro UCITS provides access to Graham’s multi-PM macro platform within a UCITS-compliant structure. Macro UCITS is a diversified macro-oriented strategy that allocates to a number of Graham’s discretionary portfolio managers as well as the Graham Quant Macro systematic trading strategy.

Discretionary Portfolio Management

Credit Opportunities

The Graham Credit Opportunities strategy takes positions across the corporate capital structure, employing fundamental bottom-up research to seek attractive risk-adjusted returns.