Systematic trading seeks out diversification to achieve more even returns while controlling risk. One way to diversify is to trade different models. But is trading different models enough?

Two systematic trading styles that are often thought of as polar opposites are trend-following and mean reversion. Using simple stylized trading signals, we show that even different models can align at times. Or to paraphrase “one person’s trend is another’s reversion”, where timescales over which market moves are observed matter.

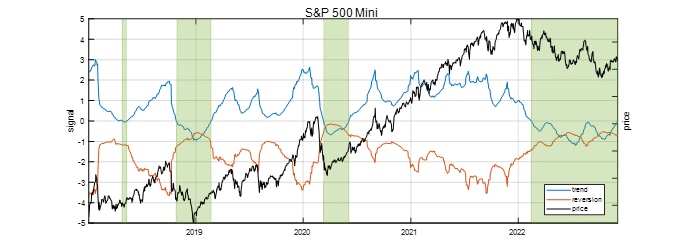

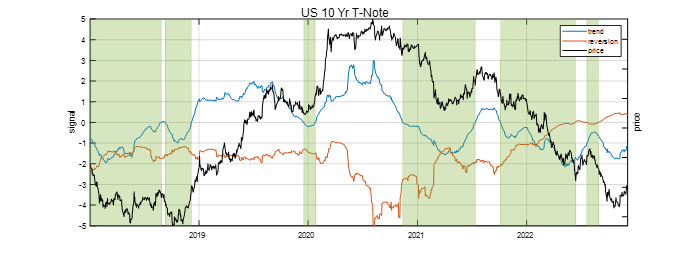

Our trend signal is a medium speed moving average crossover (MaCo), while our mean reversion signal is a very slow MaCo with a multiplicator of -1. Strong positive MaCo values for the latter therefore lead to a negative overall signal for the reversion model, and vice versa.

We show signals, alongside futures prices, for two markets, the S&P 500 and the US 10Yr T-Note. Green shading indicates alignment in signal direction for trend and reversion. Coming into 2022, equities had seen years of appreciation, with the reversion signal seeing markets as overvalued and expecting a return to a long-term equilibrium price. Early in 2022, markets corrected, with trend aligning itself with the reversion signal, which got continuously weaker as prices declined.

A similar picture emerges for bonds. With rates at historic lows right into the early days of the Covid pandemic in mid-2020, bond prices had only known one way in years – up. Rate hikes have since put pressure on bond prices, and we see a fairly steady decline in the US 10 Yr T-Note up until recently. The reversion signal has been short for years, with the strongest signal in mid-2020, indicating that bonds were far above fair value. As prices declined, trend gradually cut its long position and has aligned itself frequently with the reversion signal.

These two examples show that even models that are designed to capture very different market scenarios can look very similar at times. Thoughtful portfolio construction that takes into account such correlations ensures we do not double down on any one signal.

DISCLOSURE

This presentation includes statements that may constitute forward-looking statements. These statements may be identified by words such as “expects,” “looks forward to,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “will,” “project” or words of similar meaning. In addition, our representatives may from time to time make oral forward-looking statements. Such statements are based on the current expectations and certain assumptions of Graham Capital Management’s (“GCM”) management, and are, therefore, subject to certain risks and uncertainties. A variety of factors, many of which are beyond GCM’s control, affect the operations, performance, business strategy and results of the accounts that it manages and could cause the actual results, performance or achievements of such accounts to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements or anticipated on the basis of historical trends.

This document is not a private offering memorandum and does not constitute an offer to sell, nor is it a solicitation of an offer to buy, any security. The views expressed herein are exclusively those of the authors and do not necessarily represent the views of Graham Capital Management. The information contained herein is not intended to provide accounting, legal, or tax advice and should not be relied on for investment decision making.

Tables, charts and commentary contained in this document have been prepared on a best efforts basis by Graham using sources it believes to be reliable although it does not guarantee the accuracy of the information on account of possible errors or omissions in the constituent data or calculations. No part of this document may be divulged to any other person, distributed, resold and/or reproduced without the prior written permission of GCM.