Current macroeconomic conditions represent a sea change to the previous decade. For the last ten years, every macro shock has been met with an extremely accommodative monetary policy response. These policies created the backdrop to the phenomenal performance for “beta” that we had until 2021. However, inflation presents a unique and massive challenge to this framework as instead of responding to downside risks with more accommodation, the Fed needs to significantly tighten financial conditions even in the face of very weak risk assets (for more on this see “Global Macro Outlook: Perspective from a Long-Term Investor, Ken Tropin”).

Global macro is an investment style that can generate strong risk adjusted returns in many market conditions, particularly in contexts like the one described above. The key attributes to global macro go well beyond the fact that investment decisions are based upon macroeconomic forecasts. At its core, global macro is a dynamic and tactical strategy that can adapt to a variety of market conditions and can flourish at times of big dislocations.

Drivers of Returns

To understand why macro as a style can perform so well during volatile periods it is useful to think about how different strategies, and macro in particular, generate value. At a high level, we can group trading strategies according to how active or passive they are. We can think of the different trading styles as placed along a “continuum”. On one extreme we have strategies that mostly rely on long-run expected return estimates and therefore tend to be more passive and long-only in nature. As we travel along the continuum, we find strategies that incorporate more and more dynamic information and trade more actively. If we were to travel all the way to the other end, we will find the so-called market neutral or relative value strategies that tend to trade at higher frequency, even intra-day. Global Macro is in the middle of this continuum. Like long-run strategies, macro seeks to have outright directional exposures that are aligned with expected return estimates but since macro forecasts are dynamic, unbiased and everchanging, macro strategies are much more active. As a result of these dynamics, macro strategies exhibit very low average correlation to most risk factors, very much like market neutral strategies do. Macro generates “alpha” by successfully timing “beta”.

Another important trading style grouping is that of convergent versus divergent strategies. Convergent strategies are mostly based on mean-reversion and tend to be statistical in nature, relying on correlation and cointegration between assets. Divergent strategies, in turn, are based on the dynamical properties of markets as they move from one equilibrium to another in a way that is exploitable by a trading rule. Macro is mostly about divergence, about where are markets moving to and how to profit from such moves. The last year has been full of divergent examples and we can use some of them to better explain these concepts:

- In rates markets, as we started of the year, it was extremely clear that most Central Banks – and the Fed in particular – were asleep at the switch. Interest rates across the yield curve needed to re-price to much higher levels, but they were still held down by close to zero policy rates and QE. For example, the 5y5y real rate was close to -100bps and needed to move to positive to bring down inflation. Our strongest conviction was that expected policy rates, mostly reflected in the 2y-5y sector on the curve were going to move up by a lot. We were able to profit from shorts in multiple interest rate markets.

- In currencies, there were big opportunities coming from the fact that not all central banks were able to react in the same manner. With the Fed, we saw a central bank that for the first time one can remember had a political pressure to move to a more hawkish stance as Democrats recognized the threat from high inflation. On the other hand, the ECB was and still is highly constrained by the European energy crisis and high debt levels in the periphery and the BOJ is still pursuing their QE in the form of yield curve control. All these as well as other global developments created a super charged environment for the U.S. dollar and we were able to capitalize by having shorts is several currencies.

Summing up these concepts: macro can perform very strongly when markets, driven by changes in fundamentals, require large adjustments. By having a dynamic, tactical, and mostly “divergent” trading style, global macro can capture and profit from big market moves. Also, since bearish markets tend to be characterized by large and volatile moves, macro tends to do particularly well during distressed market conditions.

Macro Pay Off Structure

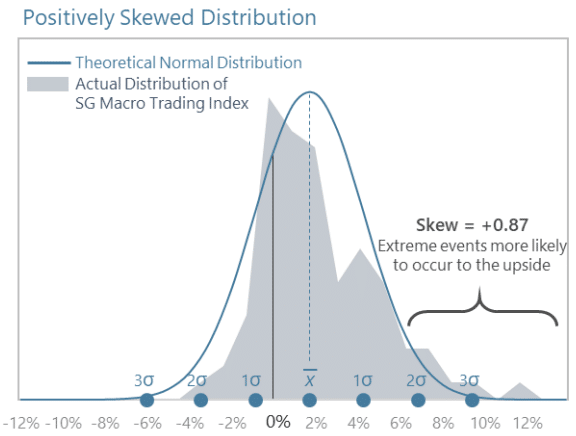

As we explained, macro strategies can profit across a variety of market environments due to their ability to go long and short a diverse, generally liquid market universe, as well as their flexibility in trading evolving market themes. Most macro strategies have been very successful in the recent market environment, as they have been able to capitalize on strong market directionality and fundamental catalysts. However, macro strategies can also experience extended periods of smaller returns in between periods of strong market directionality, as in the years leading up to 2020. Over the long term, this dynamic has resulted in a positively skewed distribution where positive extremes often occur when there are clear catalysts for directional market moves. More importantly, many of the large historical gains happened at times of big equity drawdowns. Technically, we say that while macro and equities have low average correlation, they have a strong negative conditional correlation, which is a great property for any strategy to have and very difficult to achieve. This last point is really what makes macro such a good complement to most portfolios. Macro can be a huge contributor when the portfolio is under stress and will not be a big drag during periods when the portfolio is performing well. This is true dynamic diversification.

Big Picture

The macro shocks that we are experiencing are so large in nature that it will take many years for markets to settle back to a lower volatility regime. The persistence of inflation, in particular, is not only a big problem in itself but might also force central banks to tighten a lot more than what is priced and by doing so tip most major economies into a deep recession. One big lesson that we have forgotten through so many years of stability is that once the system gets out of equilibrium it can take a long while to find stability once again. As the macroeconomic paradigm shifts, we see many investors starting to shift away from the long-only beta that continues to disproportionately dominate portfolios. What’s more, as inflation persists in tandem with a new monetary tightening regime, bond investors may see lower returns and elevated volatility, decreasing bond utility as a “safe haven” investment. In the wake of this new paradigm for global macroeconomic factors, it will be paramount for investors to allocate to strategies that can perform well in volatile environments and that add to the overall alpha and diversification characteristics of a portfolio.

DISCLOSURE

This presentation includes statements that may constitute forward-looking statements. These statements may be identified by words such as “expects,” “looks forward to,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “will,” “project” or words of similar meaning. In addition, our representatives may from time to time make oral forward-looking statements. Such statements are based on the current expectations and certain assumptions of Graham Capital Management’s (“GCM”) management, and are, therefore, subject to certain risks and uncertainties. A variety of factors, many of which are beyond GCM’s control, affect the operations, performance, business strategy and results of the accounts that it manages and could cause the actual results, performance or achievements of such accounts to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements or anticipated on the basis of historical trends.

This document is not a private offering memorandum and does not constitute an offer to sell, nor is it a solicitation of an offer to buy, any security. The views expressed herein are exclusively those of the authors and do not necessarily represent the views of Graham Capital Management. The information contained herein is not intended to provide accounting, legal, or tax advice and should not be relied on for investment decision making.

Tables, charts and commentary contained in this document have been prepared on a best efforts basis by Graham using sources it believes to be reliable although it does not guarantee the accuracy of the information on account of possible errors or omissions in the constituent data or calculations. No part of this document may be divulged to any other person, distributed, resold and/or reproduced without the prior written permission of GCM.