Over the past few years, we’ve experienced an exceptionally intriguing period in the market landscape. Shocks like the pandemic, geopolitical conflict and war, or substantial inflation spikes posed significant headwinds for traditional asset managers while creating an advantageous backdrop for more tactical investment strategies. As we look to the remainder of 2024, there continue to be several interesting developments with potentially profound market impact:

- The trajectory of the U.S. economy, particularly concerning inflation and growth and its corresponding impact on global central bank policies, is top of mind. The possibility of not only avoiding a recession in the U.S. but doing so by “soft landing” would have big implications for asset valuations.

- The synchronicity or divergence among global central banks will be a key market theme. Usually, the U.S. Federal Reserve (the “Fed”) is the most relevant actor when it comes to the level of global rates and the direction of risk assets but the behavior of other central banks vis-à-vis the Fed is critical for currency markets.

- Equity valuations and AI raise the key question on everyone’s mind: “Are we on the brink of another massive tech bubble, or is this time different?”

- Japan’s potential to change monetary policy at a time when the Nikkei is back to levels last seen around 1990 presents the possibility for some interesting market dynamics, among other global issues.

- Geopolitical volatility is expected to get worse not better, underscoring the need for robust risk management.

While not exhaustive, this list vividly illustrates an intricately complex spectrum of opportunities within global markets. Let’s expand into these topics:

The Recession That Was Not

Less than a year ago, there was a near unanimous consensus that the U.S. economy was heading for recession. Opinion surveys and quantitative models alike were assigning extremely high probabilities, as high as 90%, to a recession in 2024. For example, models based on the yield curve, which until now have shown a remarkable ability to predict recessions, flagged an almost certain recession for 2024. The reasons why we didn’t reach that point are still subject to debate (and as always, there is a small probability that we end up in recession), but I would say that consumer and corporate cash balances and balance sheets that look very strong, the rapid moderation of inflation, and looser fiscal policy are the most important reasons behind the robust growth performance.

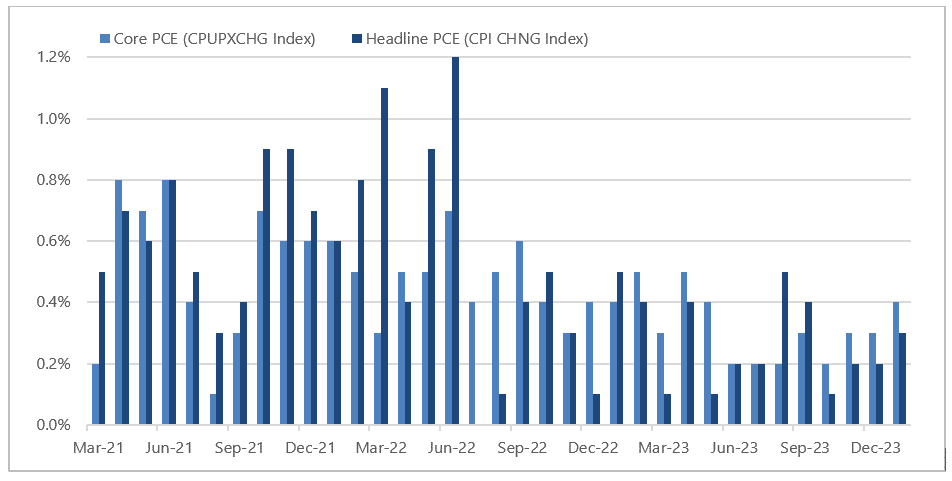

Now, not only are we evading recessionary conditions, but we are also witnessing an extremely favorable economic environment. GDP is now forecasted to be around 2% for 2024, while inflation, as measured by core PCE, is forecasted to fall to 2.4%. Despite a few setbacks as of late, inflation has fallen very quickly:

U.S. Inflation: Headline and Core PCE (MoM, Seasonally Adjusted)

From here, growth and inflation dynamics will determine whether the Fed cuts just a few times as it did in 1995 or cuts more substantially as it has historically done after a big hiking cycle. Our view, from a “Fed watching” standpoint, is that the Fed executes a few “insurance” style cuts like it did in 1995 as the economy achieves a soft landing. That said, we cannot rule out many more cuts if inflation continues to moderate or if the economy starts to weaken. The environment of solid yet stable growth, falling inflation, and easier monetary policy is clearly extremely benign for risk assets. In fact, 2% GDP is the “goldilocks” growth level, as weaker growth could bring fears of recession and stronger growth could bring fears of overheating.

Clearly, many things can go wrong, as we have seen from the risk-off shocks of the last few years. For example, a significant reacceleration of inflation could lead markets to think the Fed needs to hike again, which would be a heavy shock. However, in terms of probabilities, I like the odds of the soft-landing scenario with the corresponding risk-on environment.

What About Global Growth?

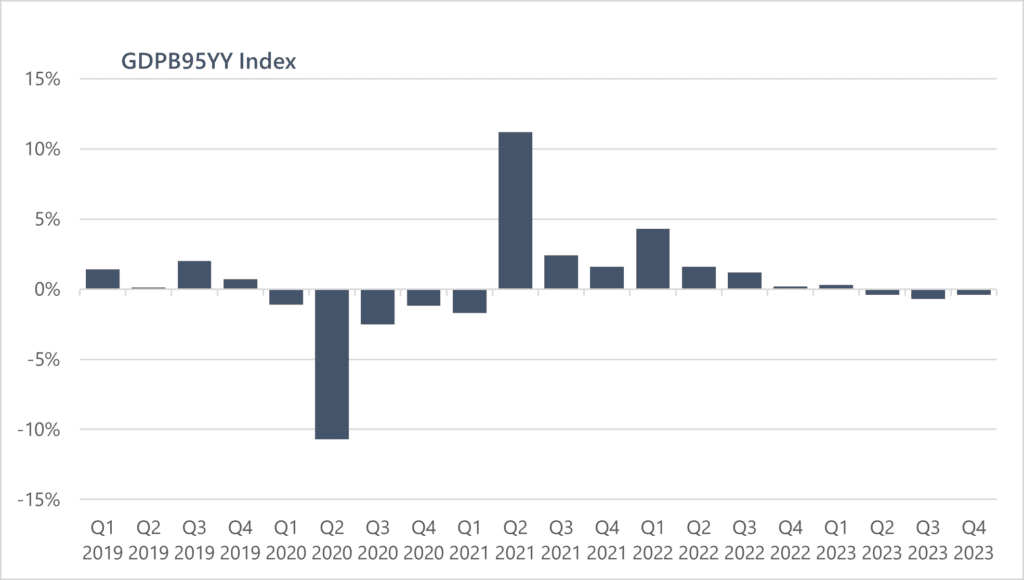

Other developed countries are facing more challenging circumstances compared to the U.S. In China, despite the hope that lifting COVID-19 restrictions would help to stabilize growth, the intentional deflating of unsustainable trends in property/infrastructure combined with Xi Jingping’s anti-growth policies, has created significant economic turbulence. Meanwhile, Europe is grappling with quasi-recessionary conditions as it continues to adjust to the massive energy shock triggered by the war. Germany has been hit extremely hard, and it is technically in recession:

German GDP (Chain Linked Pan Germany, YoY, Non-Seasonally Adjusted)

It is staggering that German GDP has not grown at all in the last three years (Q4 2023 vs Q4 2019 GDP is up 0.1%). In simple terms, Germany was an industrial complex that used cheap Russian energy as input to produce machine tools they sold to China. It is clear that this model has been extensively challenged from both sides. It is not surprising that the ECB has been extremely dovish, with the potential to cut rates as soon as June, or even April. However, this does not necessarily mean that the euro will get weaker. In the past, at the end of hiking cycles, currency markets did not tend to penalize the first cutters. Mostly, this is because developed economies are tightly synchronized, so first cutters are soon joined by other developed central banks. However, if the current economic conditions in Europe were to become significantly worse, that would be very euro-negative, as the prospects of many rate cuts, together with the fact that EUR/USD usually trades like a risk-on asset, would put significant pressure on the euro.

Equity Valuations and the Magnificent 7

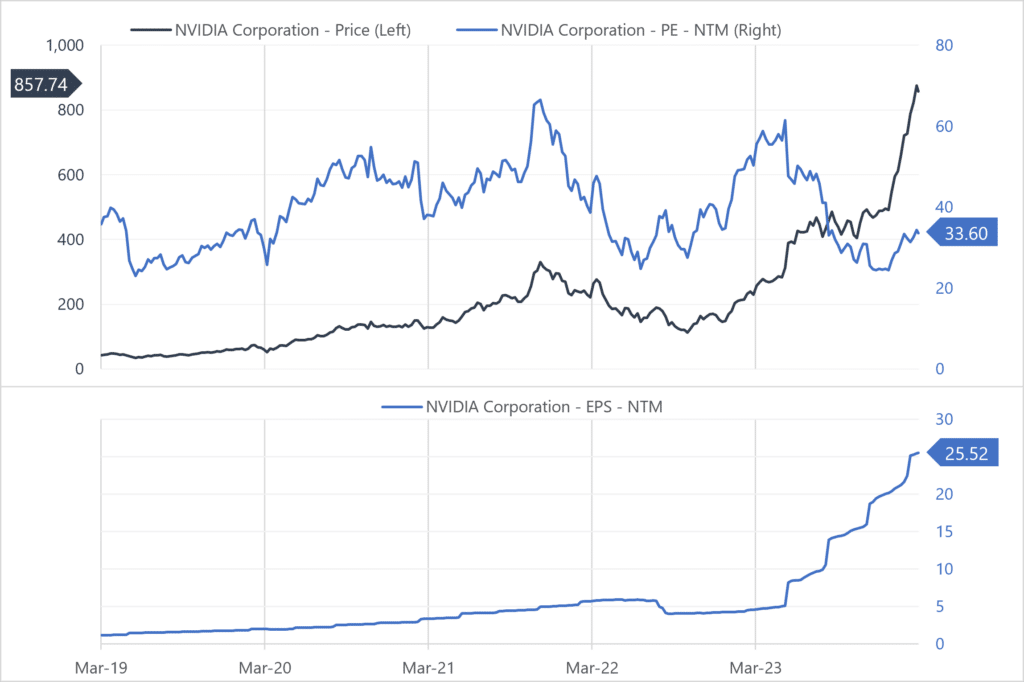

One key concern about equities is valuations. The massive performance that the “Magnificent 7” stocks have posted is leading people to think we are back to another tech sector bubble like the one experienced 20 years ago. However, a key distinction is that these are real companies with considerable revenue growth and real earnings, unlike the internet companies of the early 2000s. A quick way to assess if the price movements have been justified by their fundamentals is to look at how much of the price growth is attributable to EPS growth vs. multiple expansion. Under this metric, it is difficult to conclude that we are in a bubble and that equity valuations are not justified by fundamentals. For Nvidia, for example, we can see that earnings growth can explain a large fraction of the price performance:

Nvidia 5yr Price, NTM PE, and NTM EPS

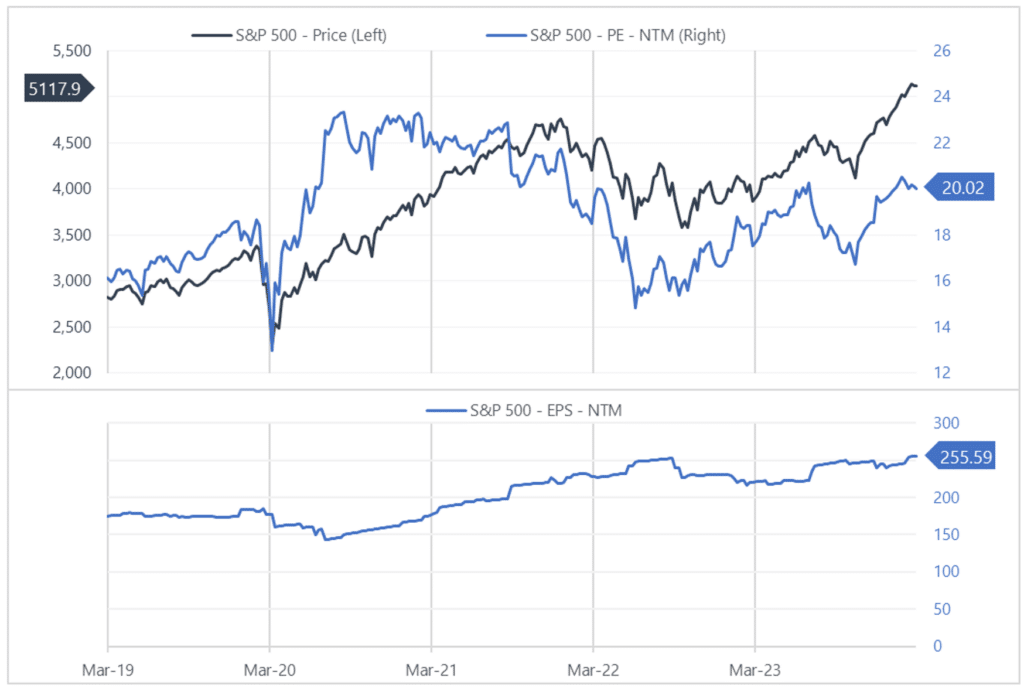

For the S&P as well, while we are in expensive territory, earnings have grown significantly in the last few years, and a large part of this price expansion can also be explained by earnings rather than by multiples:

S&P 500 5yr Price, NTM PE, and NTM EPS

I do not think that stocks are “cheap.” They are certainly trading on the overvalued side of historical ratios, but valuations are not entirely relevant in the short to medium run in terms of market performance. However, valuations do affect the distribution of returns. In particular, elevated valuations create an asymmetric distribution with a very large left tail for equities if the soft landing morphs into either a recessionary or an inflationary scenario.

Another significant determinant of equity valuations revolves around the potential for AI to create massive disruptions in labor markets. This may not be immediately tradable but requires attention, nonetheless. Take the following development regarding Klarna, a Swedish fintech company: One month after taking its OpenAI-powered virtual assistant global, the Swedish buy-now, pay-later company has released new data touting its ability to handle customer communications, make shoppers happier, and even drive better financial results. Klarna boasted in its announcement last week that the AI assistant “is doing the equivalent work of 700 full-time agents.” We might still be years ahead of the full impact of AI, but the deflationary forces that it might bring could begin to impact us in the very near future, and we need to closely monitor this.

Japan

I have always been amazed by the power of (real) exchange rate devaluations to pull economies out of recessions. I have seen the story many times in emerging markets, where devaluations tend to be abrupt and hence much more noticeable than in developed markets. At the outset, these exchange rate adjustments can create short periods of high volatility and weaker growth but almost always end up reversing and significantly boosting growth. It is interesting that Japan, a highly industrialized country, has been able to devalue its currency by so much in a manner similar to an emerging market-style devaluation:

Japanese Yen, Exchange Rate vs U.S. Dollar

The outlook for both growth and inflation looks very favorable for Japanese equities. Growth is forecasted to be around 1%, while inflation is forecasted to stay above 2%. Jointly, this creates a very benign backdrop, one that UBS has named “nominal renaissance.” This backdrop will almost inevitably lead to an adjustment of BOJ policy. It is very likely that as soon as April, the BOJ will hike rates while significantly reducing the rinban operations and ending their yield curve control. However, the rates differential to the U.S. is so large that I do not think this will cause the yen to appreciate very much in the short run. Accordingly, equities could continue to benefit from the massive tailwind of high nominal growth and an extremely cheap exchange rate.

Geopolitical Dynamics

Finally, a word on geopolitics. We are indeed living through very concerning global events that have the potential to get significantly worse. In my view, a conflict between China and Taiwan will be a shock of greater magnitude than the outset of COVID-19. It has the potential to substantially disrupt global trade, and in particular semiconductors. More importantly, it would create a constant state of tension between the U.S. and China that would certainly unnerve markets.

To add to a very complex international geopolitical environment, we are also facing what could be an extremely volatile U.S. election. Both Biden and Trump represent close to an unacceptable option for the opposition. Furthermore, each option will have a significant impact on the evolution of both of the two major international geopolitical issues, the war in Ukraine and the potential China-Taiwan conflict. This underscores the importance of being mindful of left tail risks in our positions, particularly those sensitive to geopolitical shocks.

To conclude, navigating the potential range of market outcomes demands a strategic approach to trading and risk management. Despite this complexity, the abundance of macro catalysts also creates favorable conditions for our strategies. As we move forward into the remainder of 2024, it’s clear that the trajectory of the U.S. economy, the synchronicity among global central banks, equity valuations, the situation in Japan, and geopolitical volatility will continue to shape market dynamics. While uncertainties persist, our focus remains on leveraging opportunities while effectively managing risks in this dynamic environment.

DISCLOSURE

This presentation includes statements that may constitute forward-looking statements. These statements may be identified by words such as “expects,” “looks forward to,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “will,” “project” or words of similar meaning. In addition, our representatives may from time to time make oral forward-looking statements. Such statements are based on the current expectations and certain assumptions of Graham Capital Management’s (“Graham”) management, and are, therefore, subject to certain risks and uncertainties. A variety of factors, many of which are beyond Graham’s control, affect the operations, performance, business strategy and results of the accounts that it manages and could cause the actual results, performance, or achievements of such accounts to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements or anticipated on the basis of historical trends.

This document is not a private offering memorandum and does not constitute an offer to sell, nor is it a solicitation of an offer to buy, any security. The views expressed herein are exclusively those of the authors and do not necessarily represent the views of Graham Capital Management. The information contained herein is not intended to provide accounting, legal, or tax advice and should not be relied on for investment decision making.

Tables, charts, and commentary contained in this document have been prepared on a best-efforts basis by Graham using sources it believes to be reliable although it does not guarantee the accuracy of the information on account of possible errors or omissions in the constituent data or calculations. No part of this document may be divulged to any other person, distributed, resold and/or reproduced without the prior written permission of Graham.