Global financial markets have seen some extreme shocks in the last few years ranging from a global pandemic to a war in Europe. But of all these shocks, inflation represents the biggest threat to the stability of financial markets. For the last decade, most risk-off shocks were matched with a very strong dovish response from central banks. However, inflation, due to its monetary nature, must be met with the opposite response: central banks must tighten policy when faced with inflation shocks. That means that a risk-off shock, i.e., inflation, leads to a risk-off response, i.e., tighter monetary policy. This is a game changer.

The Relationship between Inflation and Asset Returns

Given the pivotal role of inflation, one would assume that there is a very clear understanding of its impact on financial assets and how to build portfolios that are resilient to it. However, this is far from true. Partly, the problem is that when doing scenario analysis, we have to consider what the policy response would be. Would we have a Volker-like (hawkish/high real rates) response? Or would we have a Burns-like (dovish/negative real rates) response? Adding to the complexity is the fact that the relationship between inflation and asset returns is non-linear and changes sign depending on the regime. When inflation is very low and the economy is close to recession, normally interest rates will be close to the zero lower bound. In this context, higher inflation is a positive shock as it moves the economy away from deflation. However, in the context of high inflation, like the current regime, increases to inflation have a very negative effect on asset prices. This is mostly due to expectations that monetary policy will become tight and push real rates up.

Core vs Energy Inflation Components

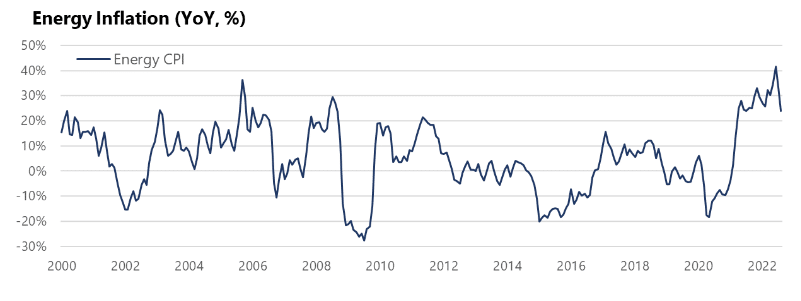

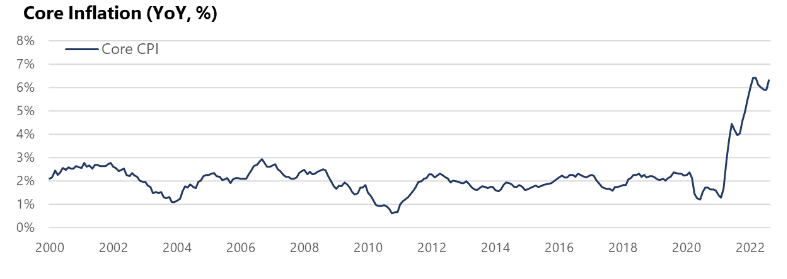

Another important factor is the source of inflation. A group led by N. Roussanov(1) from Wharton studied the impact of inflation with special focus on how the two main sub-components of CPI: the core and the energy related sub-indices, affect asset prices. They found a striking difference between shocks coming from the core component and shocks coming from the energy component. The paper sheds light on why beta estimates from using just headline inflation can be misleading and unstable as core inflation and energy inflation can have very different effects on returns. One important reason why these subcomponents affect asset prices so differently comes mostly from their statistical properties. Core tends to be very stable and highly persistent. This means that shocks to core are long lasting and hence very impactful. It also means that higher core will entice a bigger and much longer monetary policy response with the consequent effect on asset prices. Energy, on the other hand, tends to be volatile and highly mean reverting, so shocks dissipate very rapidly and may have very little impact on financial markets.

The following charts illustrate this well, showing the extreme volatility and mean reversion of energy inflation versus the stability and persistence of core inflation:

While coming up with point estimates of betas and correlations is fraught with the issues described above, our research (in line with Roussanov et al.) points to a well-supported conclusion: high core inflation is a very challenging environment for all asset classes and also for most investment strategies. The reasons lie in the combination of the magnitude and duration of policy response needed to bring core inflation down. Since core inflation is very persistent (the first order autocorrelation is close to 80%), its demise requires an extended period of tight policy, which is a difficult scenario for both bonds and risk assets. Then there are the second order effects, where higher real rates depress all asset prices which, in turn increases volatility and puts further pressure on asset valuations, creating a particularly worrisome negative loop.

Implications Across Market Sectors

At a more granular level, we can expect the current inflationary period to have the following effects:

- Fixed Income would be negatively affected by both core and energy inflation shocks. Interestingly, TIPS perform poorly with high core inflation since real rates, i.e. the yield of TIPS, have to increase significantly to bring down inflation (so much for inflation protection securities!).

- Stocks can do okay when energy or headline inflation is high but perform terribly with shocks to core inflation. Many of the losses in stocks can come from growth stocks which tend to have long duration cash flows and, hence, are more affected by increases in rates. Value stocks tend to perform well with headline inflation and neutral to marginally down with core inflation.

- Maybe the most surprising conclusion is that commodities do not hedge core inflation at all. Commodity prices increase when energy inflation is higher but not when core inflation is higher as once again higher real rates, required to bring core inflation down, have a negative effect on growth and hence on commodities. The same is true for all other real assets, in particular real estate as higher real rates impact housing demand mostly through higher mortgage rates.

- Lastly for the U.S. dollar, the situation is more nuanced as it will also depend on the inflation outlook in other countries and the response of foreign central banks. Currently with the US economy in better shape than most of its G10 peer group and the Fed leading the charge in terms of tightening, USD should continue to be well bid.

Investment Strategy Returns

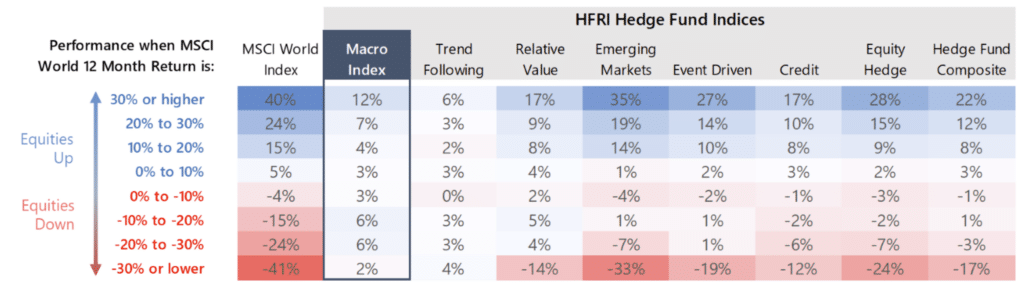

The relationship between inflation and investment styles can actually be inferred from how different styles perform across a market cycle.

As shown above, should equities manage to re-enter a bull market cycle over the next few years, many investment strategies could perform well. However, if equity returns continue to deteriorate, there are a limited number of strategies that have demonstrated an ability to produce attractive returns. Worse, many investment strategies move in sync with equities during selloffs, exacerbating portfolio losses. Macro, however, has shown the ability to perform well irrespective of the market cycle, and can participate in market rallies and also perform well in falling markets, including equity stress periods. As macroeconomic and geopolitical events continue to transpire, the range of potential outcomes remains wide, and the spectrum of risk to which an investor is exposed is greater than ever. Higher volatility regimes tend to follow periods where risk is underappreciated, emphasizing the importance of constructing a portfolio of uncorrelated alpha that is resilient to a wide range of potential market conditions.

In conclusion, in my view investors should focus not just on whether inflation is too high, but also the drivers that cause inflation, and be prepared to respond more aggressively when core factors appear to be long term in nature.

SOURCES

- Getting to the Core: Inflation Risks within and across asset classes; Xiang Fang, Yang Liu and Nikolai Roussanov, NBER Working Paper

DISCLOSURE

This presentation includes statements that may constitute forward-looking statements. These statements may be identified by words such as “expects,” “looks forward to,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “will,” “project” or words of similar meaning. In addition, our representatives may from time to time make oral forward-looking statements. Such statements are based on the current expectations and certain assumptions of Graham Capital Management’s (“GCM”) management, and are, therefore, subject to certain risks and uncertainties. A variety of factors, many of which are beyond GCM’s control, affect the operations, performance, business strategy and results of the accounts that it manages and could cause the actual results, performance or achievements of such accounts to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements or anticipated on the basis of historical trends.

This document is not a private offering memorandum and does not constitute an offer to sell, nor is it a solicitation of an offer to buy, any security. The views expressed herein are exclusively those of the authors and do not necessarily represent the views of Graham Capital Management. The information contained herein is not intended to provide accounting, legal, or tax advice and should not be relied on for investment decision making.

Tables, charts and commentary contained in this document have been prepared on a best efforts basis by Graham using sources it believes to be reliable although it does not guarantee the accuracy of the information on account of possible errors or omissions in the constituent data or calculations. No part of this document may be divulged to any other person, distributed, resold and/or reproduced without the prior written permission of GCM.