With thoughtful portfolio construction, investors can potentially achieve significantly better returns at the portfolio level than can be expected from the individual component strategies.

In a diversified portfolio, some components perform better than others over the short or long term. However, looking at the performance characteristics of individual component strategies in isolation and choosing only the highest yielding assets is not necessarily a winning strategy. Diversifying strategies that offer more muted – or even negative – returns versus other components could nonetheless contribute positively to overall returns of the aggregate portfolio.

DIVERSIFICATION ENHANCES COMPOUNDED RETURNS AND REDUCES RISK

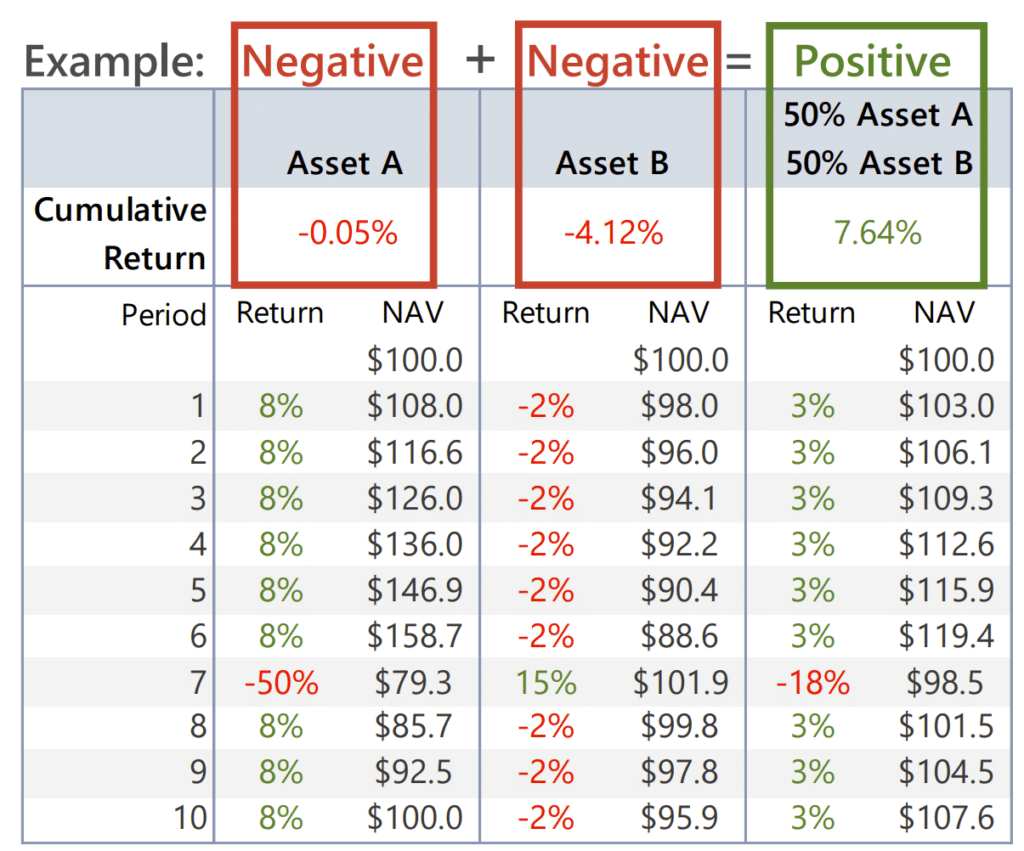

Combining assets that perform differently can enhance portfolio returns. A strategy can underperform other portfolio components yet mathematically contribute to better returns at the portfolio level. As shown below, even a strategy with negative returns can contribute positively to the overall portfolio. The benefits of compounding growth and avoiding large losses can have a significant impact on terminal wealth. Even with strong returns over many years, deep drawdowns can have a disproportionate effect on an investment portfolio, making it difficult for an investment to be restored to its former value. Portfolio diversification seeks to mitigate this drawdown risk. Specifically, investors can achieve superior risk adjusted results by allocating to a variety of return sources that have low to negative correlation to each other and complementary performance characteristics.

THE BOTTOM LINE

- Diversifying strategies are a valuable portfolio construction tool that seek to complement – rather than compete with – traditional assets.

- Investors can benefit by considering more holistic methods of asset allocation rather than placing too much focus on individual strategy performance.

- Component strategies with disappointing or even negative returns can ultimately be important contributors to performance at the portfolio level.

IMPORTANT DISCLOSURE

LEGAL DISCLAIMER

A Source of data: Graham Capital Management (“Graham”), unless otherwise stated

This document is neither an offer to sell nor a solicitation of any offer to buy shares in any fund managed by Graham and should not be relied on in making any investment decision. Any offering is made only pursuant to the relevant prospectus, together with the current financial statements of the relevant fund and the relevant subscription documents all of which must be read in their entirety. No offer to purchase shares will be made or accepted prior to receipt by the offeree of these documents and the completion of all appropriate documentation. The shares have not and will not be registered for sale, and there will be no public offering of the shares. No offer to sell (or solicitation of an offer to buy) will be made in any jurisdiction in which such offer or solicitation would be unlawful. No representation is given that any statements made in this document are correct or that objectives will be achieved. This document may contain opinions of Graham and such opinions are subject to change without notice. Information provided about positions, if any, and attributable performance is intended to provide a balanced commentary, with examples of both profitable and loss-making positions, however this cannot be guaranteed.

It should not be assumed that investments that are described herein will be profitable. Nothing described herein is intended to imply that an investment in the fund is safe, conservative, risk free or risk averse. An investment in funds managed by Graham entails substantial risks and a prospective investor should carefully consider the summary of risk factors included in the Private Offering Memorandum entitled “Risk Factors” in determining whether an investment in the Fund is suitable. This investment does not consider the specific investment objective, financial situation or particular needs of any investor and an investment in the funds managed by Graham is not suitable for all investors. Prospective investors should not rely upon this document for tax, accounting or legal advice. Prospective investors should consult their own tax, legal accounting or other advisors about the issues discussed herein. Investors are also reminded that past performance should not be seen as an indication of future performance and that they might not get back the amount that they originally invested. The price of shares of the funds managed by Graham can go down as well as up and be affected by changes in rates of exchange. No recommendation is made positive or otherwise regarding individual securities mentioned herein.

This presentation includes statements that may constitute forward-looking statements. These statements may be identified by words such as “expects,” “looks forward to,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” estimates,” “will,” “project” or words of similar meaning. In addition, our representatives may from time to time make oral forward-looking statements. Such statements are based on the current expectations and certain assumptions of GCM’s management, and are, therefore, subject to certain risks and uncertainties. A variety of factors, many of which are beyond GCM’s control, affect the operations, performance, business strategy and results of the accounts that it manages and could cause the actual results, performance or achievements of such accounts to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements or anticipated on the basis of historical trends.

Tables, charts and commentary contained in this document have been prepared on a best efforts basis by Graham using sources it believes to be reliable although it does not guarantee the accuracy of the information on account of possible errors or omissions in the constituent data or calculations. No part of this document may be divulged to any other person, distributed, resold and/or reproduced without the prior written permission of Graham.