Daniel DeWoskin, Senior Quantitative Researcher

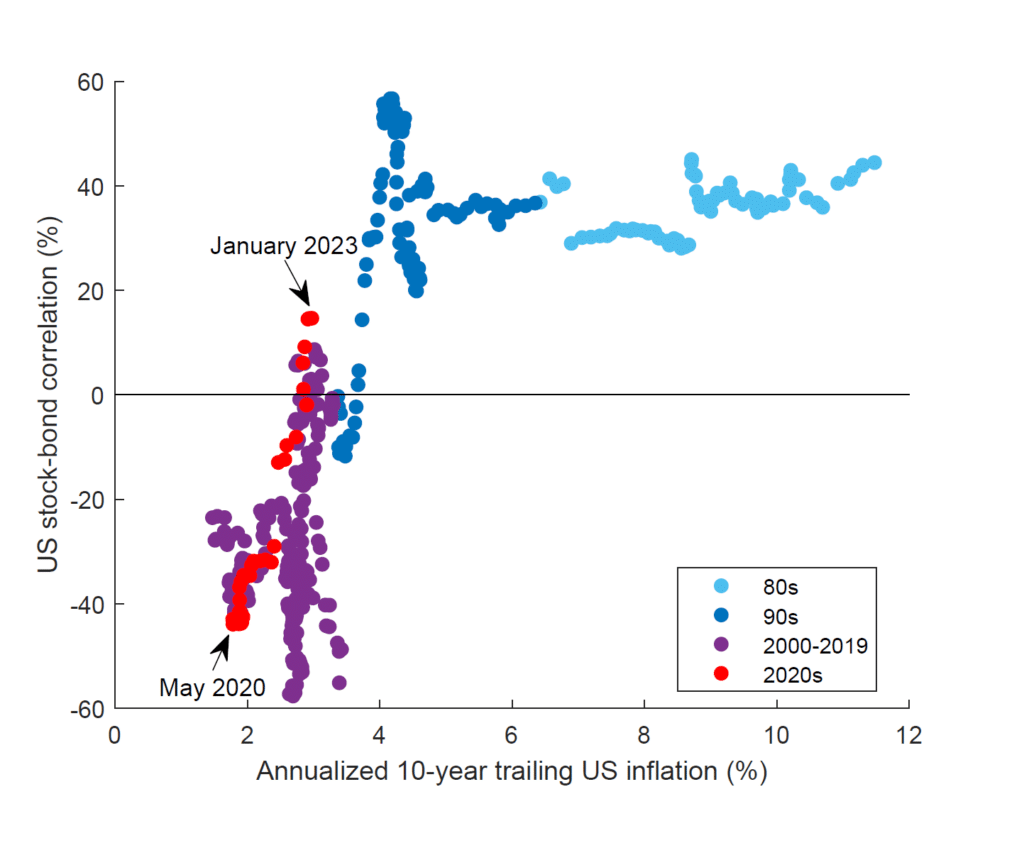

In recent years, investors have relied on the persistent negative correlation of bonds to equities to build mixed stock-bond portfolios that hedge out some of the risk of an equity market downturn. In previous white papers (Fan and Mitchell (2017), Equity-Bond Correlation_Graham Research_2017.pdf (grahamcapital.com), DeWoskin et al. (June 2020) The Winter’s Tail – Protecting Against Equity Selloffs June 2020.pdf (grahamcapital.com), DeWoskin et al. (July 2020) In Search of Negative Beta.pdf (grahamcapital.com)), we have explored this relationship and found that the negative stock-bond correlation has historically not always been so reliable. Here we show that the stock-bond correlation has actually varied over time with the transition between different inflation regimes. The figure below shows the 2-year rolling correlation between US equity and bond markets (represented by S&P 500 E-mini futures and US 10 Year futures respectively) plotted against the annualized trailing 10-year average of US inflation (US CPI). A clear trend emerges: the negative correlation is historically only seen in periods of low inflation. Consistent with historical trends, as inflation rose beginning in mid-2020, the stock-bond correlation also rose, eventually turning positive.

DISCLOSURE

This presentation includes statements that may constitute forward-looking statements. These statements may be identified by words such as “expects,” “looks forward to,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “will,” “project” or words of similar meaning. In addition, our representatives may from time to time make oral forward-looking statements. Such statements are based on the current expectations and certain assumptions of Graham Capital Management’s (“GCM”) management, and are, therefore, subject to certain risks and uncertainties. A variety of factors, many of which are beyond GCM’s control, affect the operations, performance, business strategy and results of the accounts that it manages and could cause the actual results, performance or achievements of such accounts to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements or anticipated on the basis of historical trends.

This document is not a private offering memorandum and does not constitute an offer to sell, nor is it a solicitation of an offer to buy, any security. The views expressed herein are exclusively those of the authors and do not necessarily represent the views of Graham Capital Management. The information contained herein is not intended to provide accounting, legal, or tax advice and should not be relied on for investment decision making.

Tables, charts and commentary contained in this document have been prepared on a best efforts basis by Graham using sources it believes to be reliable although it does not guarantee the accuracy of the information on account of possible errors or omissions in the constituent data or calculations. No part of this document may be divulged to any other person, distributed, resold and/or reproduced without the prior written permission of GCM.